Time is on your side so make the most of it. Set yourself up for success so that as you age, you continuously increase the flexibility with which you build your life. Your future self will thank you for it.

1. Open A Roth IRA

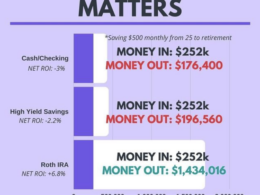

A Roth IRA is a retirement account anyone can open, except for those with income limitations. Once you get your first job, save $1,000 and open a Roth IRA account with any financial institution such as Fidelity, Charles Schwab or Vanguard. Then commit to making automatic monthly payments to your Roth IRA. Even $20 — $50 a month will make a difference. Then, you must choose where the money that is in the account will be invested into. A “Target Retirement Fund” is an appealing selection for people who have little knowledge or interest in monitoring their investments. Why? The financial institution will automatically balance the risk of your portfolio as your approach your retirement date so that you can cash out your investments.

It doesn’t matter if you’re making below $60,000 annually. It’s extremely important that you immediately start putting money away for retirement even if you never want to retire. If you would like to buy a home in the future or pursue higher education, you could even borrow money from your Roth account with fees that may be lower than other lenders.The earlier you start, the longer that compound interest can accrue in the Roth IRA.

2. Get Your Driver’s License

For Angelenos, this one may seem like a no-brainer, but the reality is that those who have not driven in their teens face higher car insurance rates due to their shorter history of driving experience. Having a driver’s license at an earlier age will dramatically reduce your future insurance bill. By having a driver’s license at an earlier age you can save up to hundreds monthly on your car insurance bill.

3. Open A Credit Card Line

Start building your credit history ASAP so that you can start building your credit score. The Finance Snacks community has had positive AND negative experiences with debt. It’s not debt that’s toxic, it’s the type and way that you use it that is toxic.

Where to start? Open a credit card with with a low credit limit (~$2,000 or less). Pay your monthly groceries with this card and then make sure to pay the full balance at the end of each month. The goal is to start building a credit history so that when you decide to buy a home or a car, your interest rate will be lower if you decide to purchase either with a loan. These lower percentage points in interest can translate to thousands of dollars saved.

4. Learn How To Cook & Meal Prep

The earlier you learn to cook and meal prep, the easer it becomes to make it a habit. Meal prep saves you time, money, and prevents food waste. It can also help you to have a tighter grip on your nutrition and reduce the temptation to eat out.

5. Change Your Money Mindset

This one is a bit harder when you’re just starting out, but it’s important to think of buying things relative to how much time it took you to make that money.

For example, you suddenly develop a passion for buying candles and before you know it you’re buying $30 candles. What’s $30 right? Well, $30 can be one week’s worth of gas, 30 tacos, 10 In-n-Out burgers, and more importantly, 2–3 hours of YOUR labor.

If you want to work less as you age, minimalist habits can help you do that without having to make large pay jumps. That doesn’t mean you shouldn’t purchase luxury items. On the contrary! Purchasing fewer items and focusing on higher quality can improve your quality of life.

6. Become More Intentional With Your Money

Try giving yourself a goal of having no-spend habits. Remove all promotion emails from your main inbox and instead dump them into a junk email.

Become less reactionary with your money. “70% off new shoes. Hmmm, I do need new shoes.” But do you really need new shoes?

If you had never seen that ad would you have thought, “I need new shoes” or are you thinking of “new shoes” because of the ad? So, remove those promotions from your primary inbox and dump them into your junk inbox so when you do need something you can make most of those promo codes. Or also, try using the Honey chrome extension which helps save you money by applying existing promo codes.

7. Create A Daily Spend Limit

Start thinking about having a daily spend limit. This daily spend limit should match how much you can actually spend. So let’s do the math for a second shall we:

Let’s say you have monthly fixed costs of $1400, this is all of your monthly expenses you HAVE to pay to literally survive like rent, groceries, etc. And let’s say you make (or via financial aid) $2000 on a monthly basis. So incoming money $2000 — fixed costs $1400 = $600. $600/30 days means you have a daily limit of $20. So how does that $30 candle look like now? Are you willing to spend a day’s spend limit and then some for a candle?

For all the money you don’t spend drop it in a savings account or a fun account. Don’t forget you’re young and it’s totally okay to have fun.

Takeaways

Setting yourself up for success means creating a history of good habits. The longer your credit history the easier and cheaper it’ll be to get an apartment or even your first car.

Now go make some money moves!