Investing is passive income. In short, it is money you earn without putting much effort into it. So if you’re wondering how you’ll reach financial independence (the need to no longer work to “survive”), a huge part of it is building passive income like investing!

Now, a lot of people are wary of investing because of the many stock market crashes we’ve had, and just to note, their average intervals are getting shorter. So yes, do your research. Nonetheless, through proper risk evaluation and diversification, it is a worthy investment when you’re fighting the average 2% inflation that eats at your money sitting in your savings account every year.

So let’s get started!

1) Determine if you’re ready to invest

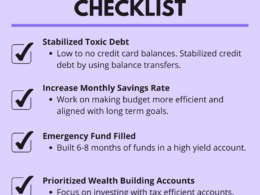

We only recommend investing if you have completed the following:

- Fill your 3-6 months of your emergency fund (3-6 times your fixed costs, and after you start investing continue to fill it up to 6-8 months)

- Stabilize your toxic debt

- Determined your risk tolerance. Here’s a good questionnaire from a Missouri University and another from an investment adviser Vanguard.

2) Understand the basic principles of investing

- Understand it’s not risk-free.

- No one can time the market. No one can always be right. Always assume “no one knows.”

- Focus first on long-term investing within index funds.

- Stay diversified.

- Adjust risk tolerance according to age.

- Set dates to rebalance your portfolio.

3) Do your research!

As with all investing advice, take everyone’s advice with a grain of salt, including ours! It is important that you do your own research and DO NOT stock pick unless a) you’re diversified b) have done enough research and c) are able to survive if you lose the money invested in that sock.

4) Invest in Index Funds (mutual funds / ETFs) or Target Date Retirement Funds

Funds focus on investing in a variety of financial products. There are so many different types of funds. There are ones that invest in the top 500 company stocks in the United States or some that invest in the top 500 company stocks internationally. But here’s what’s usually recommended:

– Total US Stock Market Index Fund

– International Index Fund

– Total US Bonds Index

– Total International Bond Index

– US REITs (Real estate investment trusts)

Perhaps the easiest way to get started is with Target Date Retirement Funds. Target Date Retirement Funds are funds that have a “target” retirement age. The fund then adjusts the risk level as it gets older so that it works towards the retirement goal. They usually have a retirement year goal date in the fund. For example, let’s say a 19-year-old wants to get started on investing in a Target Date Retirement Fund and is assumed to retire at the age of 67, that fund will assume a risk tolerance of 48 years of investing which will look like the following mix:

Stocks (“more risky”, high returns) 90%

Bonds (“less risky”, less returns) 10%

Meanwhile, if a 50-year-old wanted to invest in a target retirement fund, the mix will assume 17 years of investing and will look as such:

Stocks: (“more risky”, high returns) 20%

Bonds: (“less risky”, less returns) 80%

The idea is that bonds are less volatile than stocks and as you near retirement age, you want your portfolio to stabilize and be less risky and thus provide fewer returns. So the younger someone is the riskier their investments should be because with time they have many years to recover from market “downturns.”

The following companies (at the time of this writing) have Target Date Retirement Funds: Fidelity, Charles Schwab, and Vanguard. Vanguard is everyone’s favorite because John Bogle (their founder) pioneered the importance of low expense ratios and long-term investing. You can get started from $50 – $1000, just check to see what’s the minimum requirement.

Also, quick note, make sure the expense ratio is 0.75% or below, or whatever your preferred level may be.

5) Rebalance your portfolio at least twice a year

Over time your returns may grow whereas you started with 80% stocks, but end up with 85% stocks. Set up two annual calendar dates when you wish to rebalance it.

—

The Takeaway

If you’re still feeling apprehensive, at the very least, toss up $1000 in a target retirement fund and ease into investing. (You can also check robo-advisors, though most of their returns haven’t been amazing per our practice.)

Check it out after 1 year and see how you feel about the process. You should be receiving 5–7% at the minimum! Safe investing!