Investing is simple and at a high level it should be kept simple. What’s investing? It’s putting a certain amount of your own money into something you think will give you higher returns in an x amount of time. What’s the stock market, it’s the same thing but a whole market of everyone doing this at the same time at an exponential level. Everyone is trying to see where they can make money, and sometimes at the expense of someone’s else’s mistakes.

When you’re first thinking of investing you may be focused more on risk. How do you know if the $20-$50 you first put in will give you more than you put in? Well, you don’t. Focus on how you think about risk, and try to understand your specifics.

One good way beginners dive into investing is by dipping their toes into index funds. For the sake of simplicity, do an easy google search on top performing low cost index funds, pick one, pick a brokerage and invest $250-$500. After a few months or so, see how you feel about it, and grow from there.

When investing here are the following recommendations we have.

Step 1: Get Your House In Order

- Pay off all your toxic debt

- Fill up your emergency fund (no, the stock market is not a place to keep an emergency fund and we’ll explain that in another post)

- Have a budget you’re in control of

Step 2: Have a Plan, Start Investing

- Pick what you would like to invest in, dip your toes with index funds and make sure they are high performing over the last 5-10 years. Also check their expense ratio, otherwise known as their fees. A simple google search will help you figure this out.

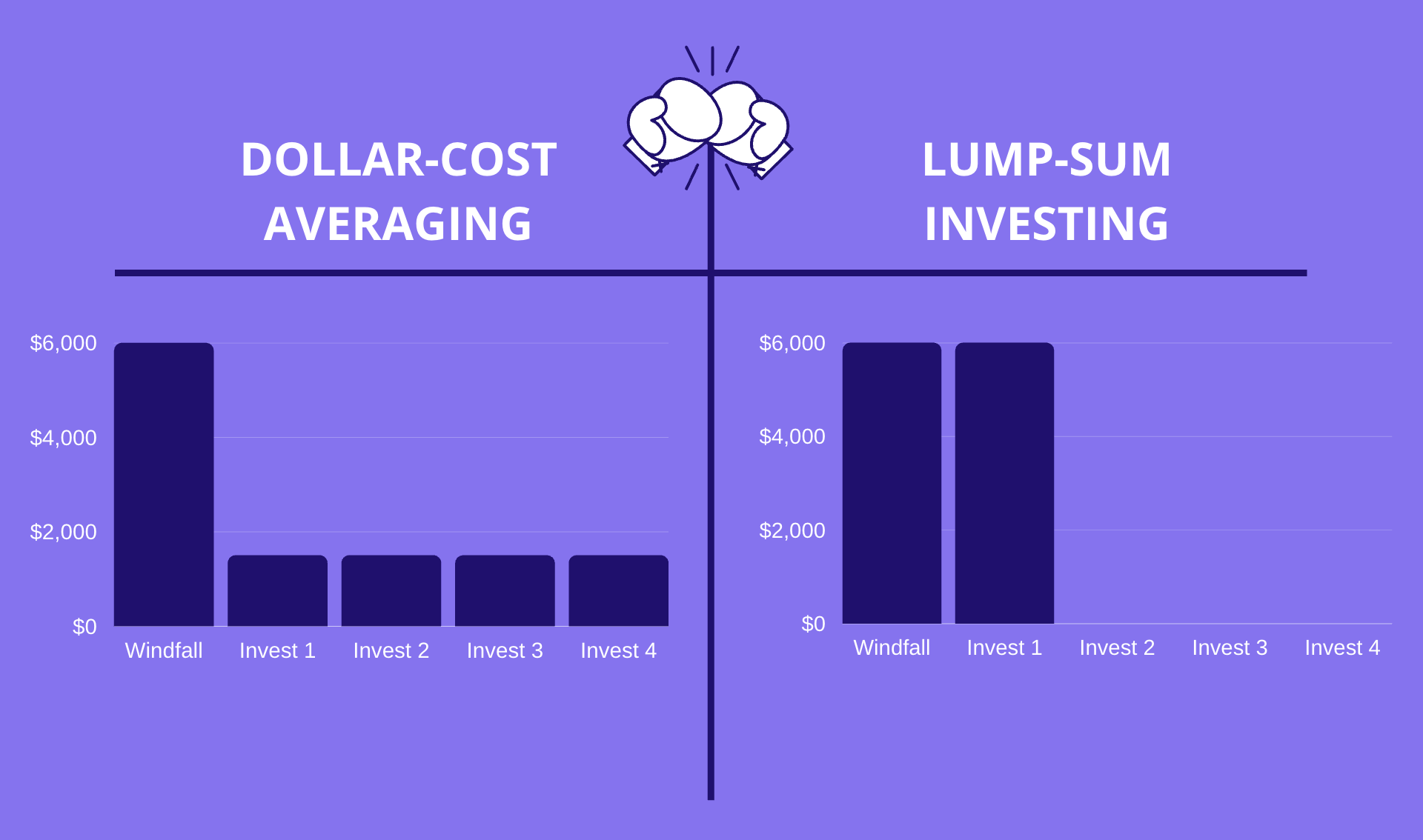

- Again, we’re all about simplicity here, so this is how we recommend it, DCA every month or per paycheck in whatever you decided to invest in. If you picked an index fund or 2, split that $250 into those index funds with allocation percentages, 50% in this one, 30% in that one, 20% in the other. And do this on a fixed date basis as if you’re paying your monthly bills.

- Have a crisis management plan, take a post-it note, and write the top 3-4 things you would do if the stock market tanks 50%. Our recommendation (per extensive research) is to hold, but we know everyone’s situation might be different and you may be over-leveraged or have an emergency, so you may need to reallocate or figure out which account to withdraw from. Have a plan you can rely on, one that you thought through when you weren’t in a crisis.

Index funds is mutual fund or exchange-traded fund (ETF) that allows you to invest in a set of rules that tracks a specific basket. Sometimes they track the market’s top performers or tech’s top performers. It’s a way to invest in everything without having to pick one thing.

– First Milli

Let Us Know How It’s Going

Please let us know how it’s going. Leave us a comment, send us an email, or a DM on our socials. We’d like to learn what’s holding you from investing. For the pros out there, what would you add?