Okay, so you’re finally happy with what you want to invest in, you assessed your risk tolerance and you figured out which platform you want to use. Okay cool, but now there’s the question of how much and if you should invest it all in one go.

Let’s say you have $5000 and you’re trying to dip your toes into investing, should you invest the full $5000 or should you break it own. If you’re just starting out, this can be a scary decision, “what if you lose it all.”

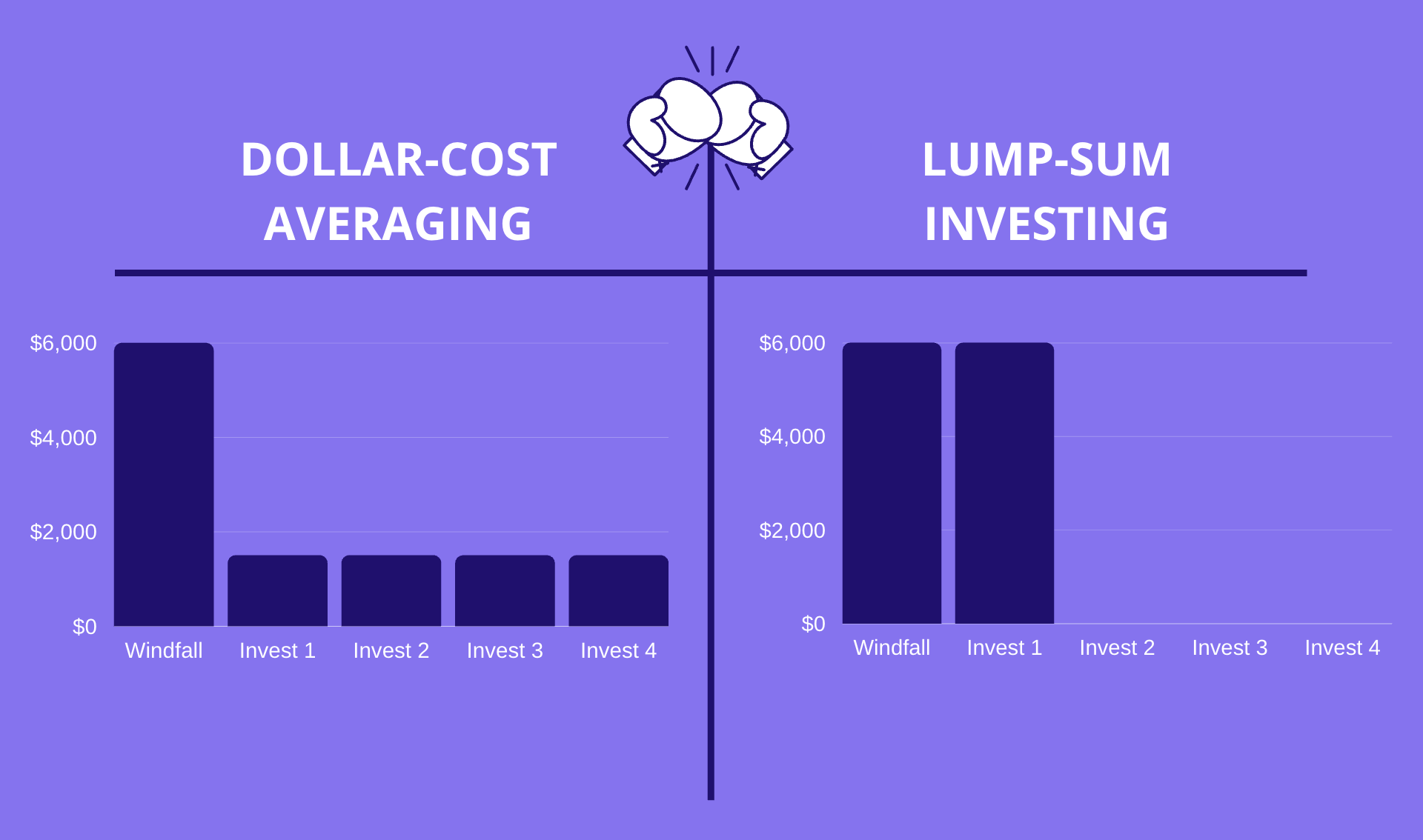

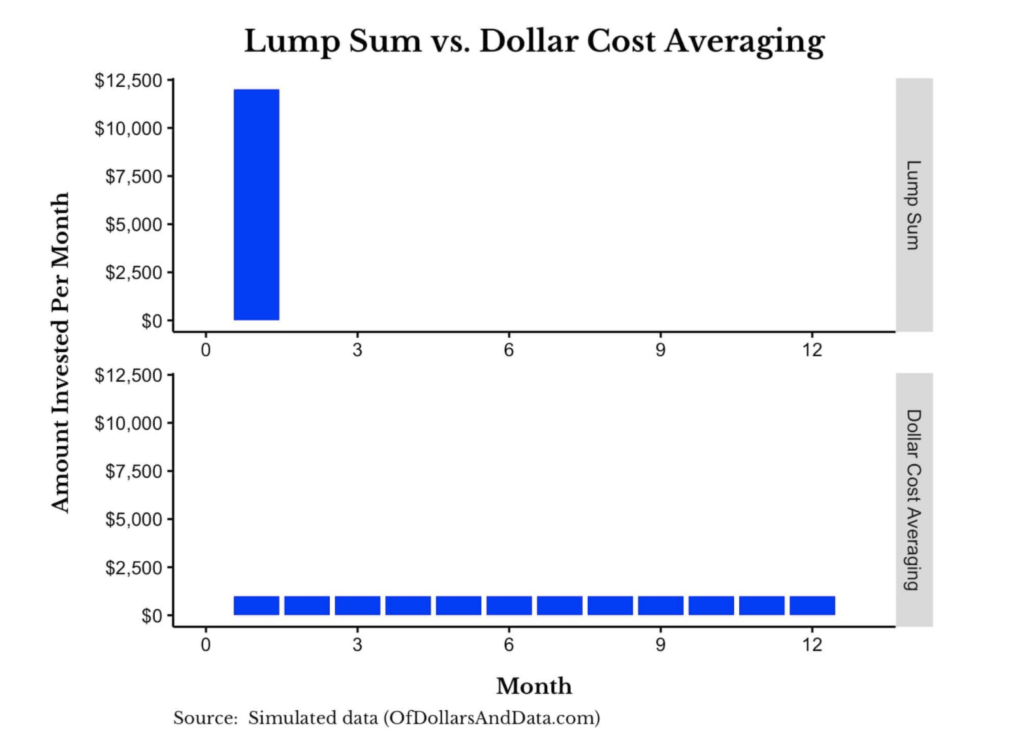

Dollar-Cost Averaging (DCA) is investing all of your investable money over a period of time. . For example, the current maximum contribution for Roth accounts (for those under 50) is $6,000. So instead of maxing out your Roth account in one go, you’d contribute $500 on a monthly basis until you’ve reached $6000 within a year. DCA helps you spread risk over time as the stock market moves up or down. This helps you ignore the headlines and stay true to course.

Lump-Sum Investing (LS) is investing all of your investable money at once. Let’s say you get a windfall of $5,000. With Lump-Sum Investing you’d pick WHAT you’d want to invest in and immediately invest the entire $5,000 in one go. This lets you get into the market quicker and start putting your dollars to work.

Quote: “The market can remain irrational longer than you can remain solvent.”

“The market can remain irrational longer than you can remain solvent.”

John Maynard Keynes (a famous economist) supposedly once said

The goal of this article is to illustrate the importance of having a capital deployment strategy.

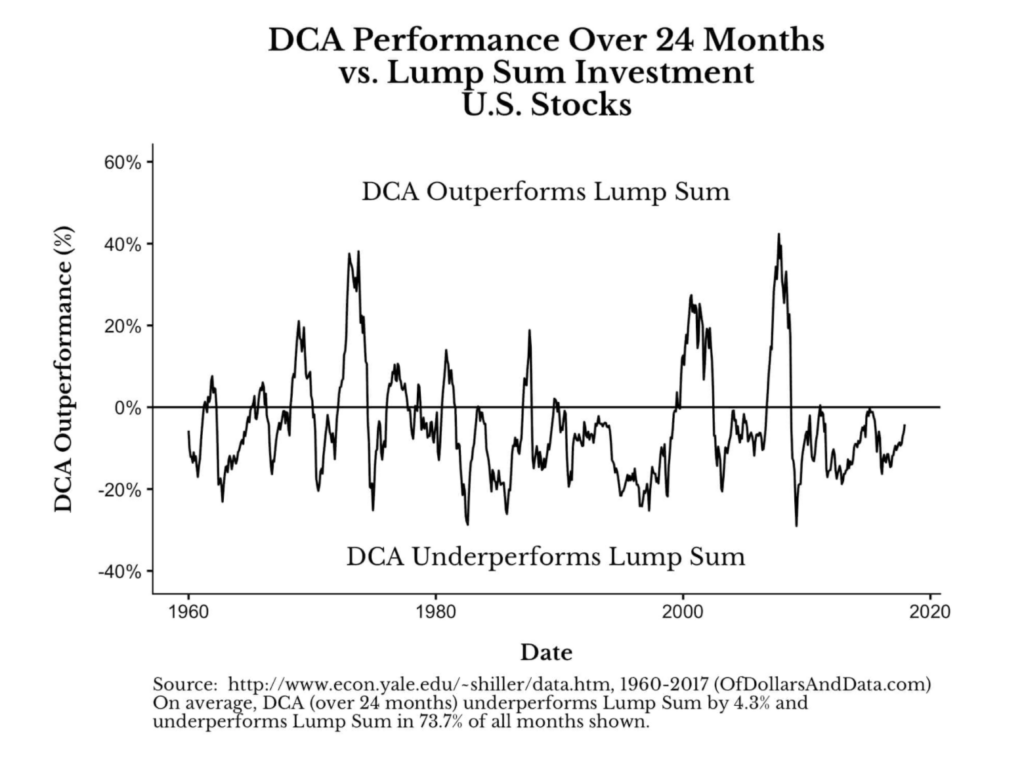

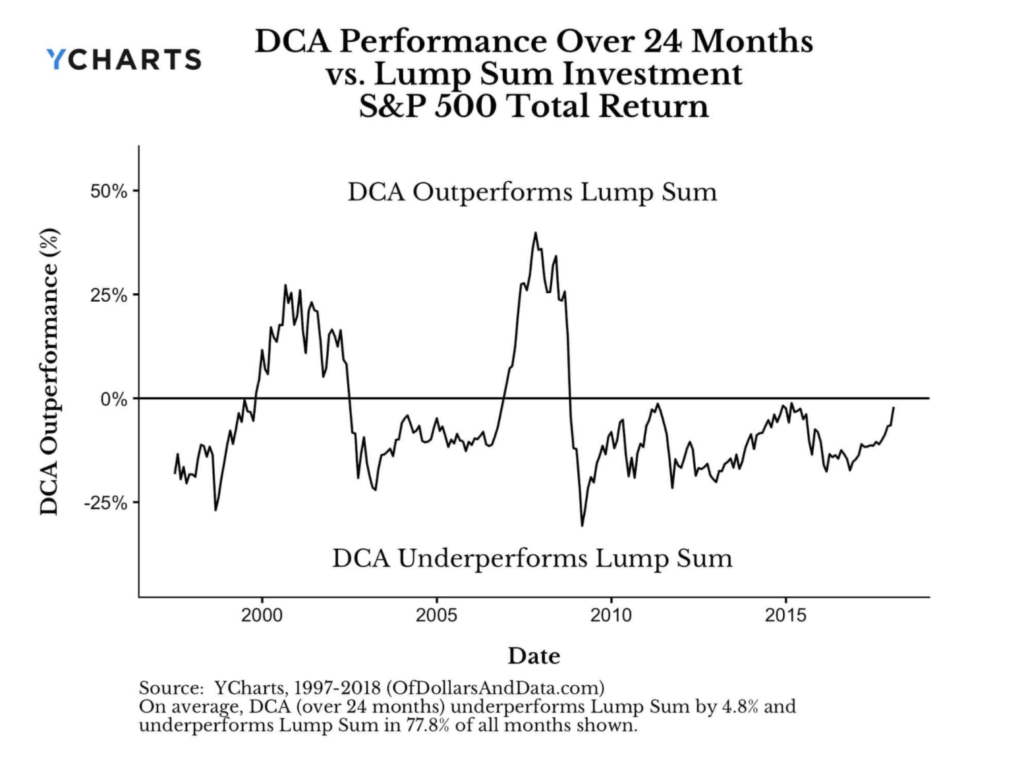

Through long term history, Lump-Sum Investing has performed higher. However, one could argue that this new tail end of the stock market does not reflect that of the stock market’s history. That we have entered a new period. Today, we have social media, we are bombarded on a daily basis with headlines. We are now competing with AI/Machine Learning algorithms from hedge funds with billions of capital to leverage with. There are now more people investing in the stock market. We even have the ability to invest in a stock FROM YOUR PHONE.

To help your decision-making strategies these are the conclusions we have arrived to:

Dollar-Cost Average Investing is best for:

- New investors with a low risk tolerance

- Investors with a general low risk tolerance

- Investors who are wary of market crashes and still want to invest

- There’s enough data to show that LS outperforms DCA long term, so ultimately it is mostly used as a hedge against feelings

- You can think of it as training wheels before riding your bike

Lump-Sum Investing is best for:

- Investors who want to make their hard earned dollars start working in the market

- Investors who just want to “get it over with”

- Investors who can stomach the risk and put their faith in the long-term strength of the stock market

- Investors who understand their risk tolerance and assessed their portfolio risk breakdown

DCA has proven to outperform Lump-Sum Investing within a period of frequent market crashes (1974, 2000, 2008) as long as the available investable funds are invested with 12-24 months. Nonetheless, in terms of long-term data, the winner here is Lump-Sum Investing. It’s best to get your money working for you ASAP.

What’s your personal favorite? How do you distinguish between acting on your capital deployment strategies? For example, maybe you might be comfortable doing lump-sum with a $15,000 windfall, but not with a $30,000 one.