If you’re like me, you probably spent a moment reflecting on what a time 2020 was, am I right? Well, let’s go a little deeper. Typically, people think about their weight or certain vices around the new year, but I want you to think about your relationship with money. This year, we’re taking 2021 for all that we can! But how? Let’s run through some tips for how you can improve your financial wellness and start wealth building like a pro.

First things first, you have to reflect. Consider these questions:

- Did you have any financial goals last year?

- Did you achieve them?

- What went well when it came to money?

- What didn’t? Were there any unexpected life changes (like, losing a job or hours due to COVID-19) or purchases (like a new laptop or car) that you had to deal with?

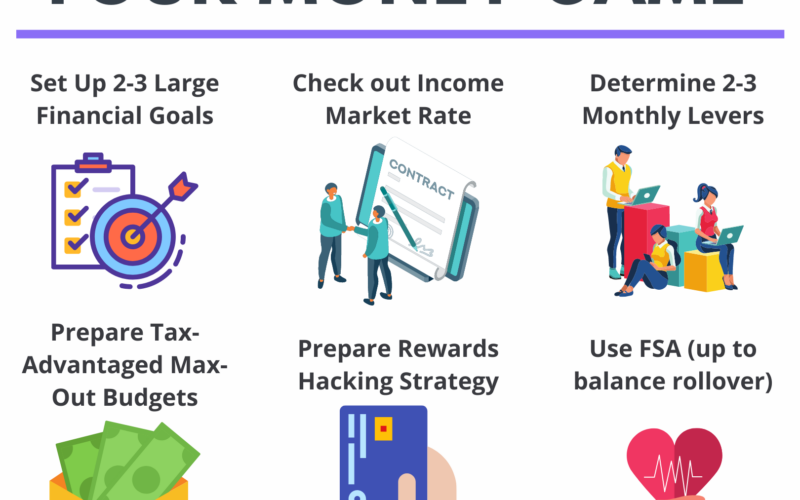

Set 2 – 3 Large Financial Goals

Now that you’ve thought about these questions, you should set two to three large financial goals. Your financial goals can be anything. Think about the long term and short term life goals you may already have, but that you might not have really thought about too concretely. For example, an obvious one is retirement. Another might be buying a house for your family, or getting a bigger car. Whatever your goals are, it’s important to be as specific as possible. This means giving yourself a timeline. For example, let’s say you’re 25 and your goal might be to save enough for a 20% downpayment on a $320,000 home by the time you’re 40. How much would that be a month? (answer: about $360 a month) Ultimately, you want to know how much per paycheck you need to contribute toward your goals based on a set deadline.

Make sure to check out our calculators to help you determine how much you’d need to contribute a month towards any of your savings goals!

Check out your income market rate.

If you haven’t already, you should look into how your salary or hourly wage stacks up on average. You can compare your salary or hourly wage by searching your job title, career field, location, and experience on any of the following websites:

- Salary.com

- Glassdoor

- PayScale

- Indeed

- SalaryList

- Salary Expert

- Bureau of Labor Statistics

I would compare the average on at least two or three of these websites to see where you’re at. Maybe it’s time to ask for a raise or consider applying for a new role that will pay you more. You always want to know what your options are and what you may be holding out on. You’ll reach your goals faster by increasing your potential income.

Determine 2-3 monthly levers

What’s a lever? Think of it as a variable that you can adjust to reach your financial goals. For example, if you want to increase your monthly investing rate, what are some things you can change? One thing you could do is try “no spend days.” If you’re used to ordering out lunch and dinner, try cooking your meals one more day a week than you usually do. These little shifts in your habits can make a big difference over time. How many “no spend days” would you need to save another $100 a month?

Here are a couple other examples of levers you can try out:

- Adjusting your daily spend budget. If you have a budget for discretionary spending, maybe try lowering it for four days out of the month. Instead of spending $30 on eating out, try spending $20.

- Challenge yourself when shopping when grocery shopping. Instead of buying name brands, try only buy whatever you can find on sale. I personally try to map out how long each item will last and how many meals I can get out of it.

Prepare tax-advantaged max-out budgets.

In our articles about Roth IRAs, we mention that they have a max contribution limit. We also mentioned that the Roth IRA is one type of tax-advantaged account. Here is a quick list of the types of tax-advantaged accounts you may have or qualify for, and their contribution limits. Each one has a specific purpose, so think about which ones matter the most to you.

Tax-Advantaged Account Contribution Limits for 2021

- Roth or Traditional 401k: $19,500

- Roth or Traditional IRA: $6000, or if you’re 50, then it’s $7,000

- Health Savings Account (HSA): $3,600 for singles, and up to $7,200 for family plans

- Flexible Savings Account (FSA): $2,750, with a max rollover of $550 for select plans. This is an alternative to the HSA

- 529 College Savings Plan: $235,000 to $500,000 depending on the plan. You can choose a plan from any state

If you wanted to contribute the maximum amount to a Roth IRA for example, then you’d need to shell out $500 a month. Keep in mind you should not over-invest. A rule of thumb is to keep your savings or investing rate between 10% to 40% of your income. Keep in mind everyone’s lifestyle is different, so this might be easier or harder for you depending on your situation. You can start investing with as little as $25 a month.

Prepare rewards hacking strategy

On our IG, we posted about how credit card rewards hacking could save you some money on flights! (Full article coming soon!) Think about what your frequent expenses are and use rewards programs to stretch your money towards your financial goals. If you spend a lot on groceries and gas, consider using a credit card that can give you points for flights based on your spending. This is basically free money, so why not take advantage of it? Make sure you understand the mechanics of whatever rewards you want to use. Also, remember to keep your credit utilization between 10% and 30% (the lower the better). You don’t want to “over-hack” a rewards system at the risk of hurting your credit score. The idea is just to take advantage of your normal and necessary spending habits.

Use FSA (up to balance rollover)

FSAs are a great way to save some money by allocating a portion of your paycheck tax-free to pay for dental, vision, and medical expenses. FSAs have a “use-it or lose-it” policy, with the exception of those with a balance rollover of up to $500. We have a whole IG story highlight dedicated to some of the “aha” moments we found when it came to utilizing these. Did you know that most healthcare or wellness items you can find in a drug store or grocery store qualify?

What financial goals are you trying to knock out for 2021? What are your big money questions?