Even though the unemployment rate peaked at 30% in the first half of 2020 as a result of COVID-19, the stock market since then has not been affected.

Most are perplexed as to why the stock market can continue going up while the economy continues to trend downward. Below we outlined a few points reflecting why the stock market is trending upwards. We also highly recommend this long but amazing article by the NY Times.

Stock Market Basics

The stock market, or the stock exchange, enables you to buy, sell and trade stocks where you are able to bet on the price of a company’s value. Buyers who believe a public company will perform well, will bid high, and those that will perform poorly, will bid low.

The stock market is performing well simply because buyers and sellers are optimistic about the companies that are publicly listed.

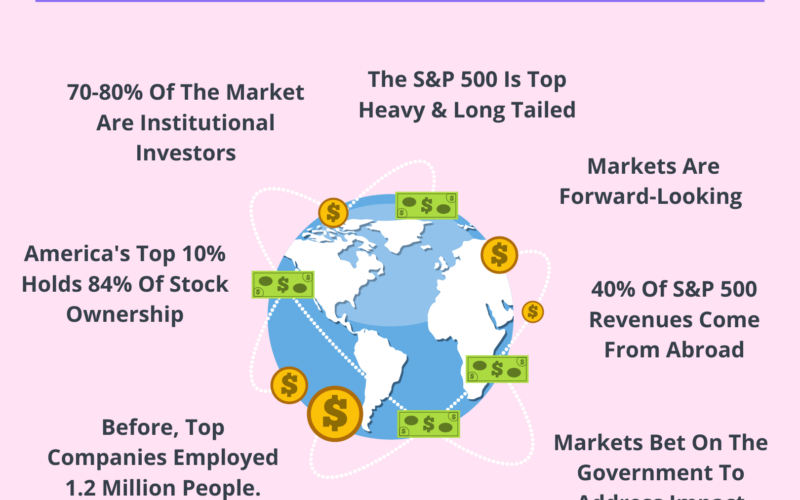

1. The S&P 500 Is Top Heavy & Long Tailed

The top five companies in the S&P 500 — Amazon, Alphabet, Microsoft, Apple, and Facebook — went up dramatically in 2020 compared to the rest of the listed companies. According to Goldman Sachs analysts, these companies are each worth more than $1 trillion, accounting for 20% of the overall value.

2. 70-80% Of The Market Are Institutional Investors

Currently, a good percentage of the country are unemployed, unable to pay for rent, bills, or essentials. This group is not reflected in the stock market performance because the majority of shareholders in the S&P 500 companies are institutions. These institutional returns do not return to individual investors, but rather to the institution themselves and those employed at these firms. But you might think, wait, I invest via Vanguard, doesn’t that mean I’m an institutional investor. No, you’re actually classified at an individual level. So if you’re investing independently via a Roth IRA at Vanguard you are not considered as institutional ownership.

However, services such as Public or Robinhood are dramatically changing the game. Allowing for an everyday investor to invest, even with as little as $1 via fractional shares. In 2020, there was a record number of retail investors, accounting for up to 20% of stock market investors.

(Psst, shameless plug: If you’d like to invest with Public, click here to start investing with $10 in your account.)

3. Markets Are Forward-Looking

The market usually recovers several months before a recession ends. Stock investors monitor the economic GDP, employment, and inflation rates provided by official government entities. They also have close relationships with the leadership of top companies like Apple, Alphabet, Tesla, and Facebook and can gain insight as to how they’re seeing future potential earnings. For example, if Tesla starts reporting an increase in the purchase of vehicles or if Alphabet starts to monitor an increase in small business ad purchases, then investors will predict that the economy is improving. Because many of these companies have users in the millions, they are able to monitor changes quickly and at a big picture level.

4. The Market Is Betting The Government Will Address COVID-19’s Impact

You’ll notice that the stock market usually drops when stimulus fails to pass. When there is a government deadlock or when investors believe that support will not be passed, stocks drop. You might recall in 2008, when big banks failed to do proper due diligence with mortgages, the government ultimately bailed them out. Thus, the market often wagers the government will address large economic issues, and they often do.

5. America’s Top 10% Holds 84% Of Stock Ownership

The top 10% of individuals in the United States with the highest net worth have some of the most diversified portfolios. Thus, even though COVID-19 has negatively impacted the value of some of their assets, their extremely diversified portfolio has allowed them to absorb risk.

6. Before, Top Companies Employed 1.2 million people. Today, Top companies Employ 280K

Even though many of us, our family and friends have been struggling to make ends meet. The stock market does not reflect this because those working in the stock market’s top companies (~S&P 500) are working (0.17%).

280k S&P 500 employees / 163m workforce = 0.17%

The number of people employed at top companies has gone down because technology has made it possible for more work to be achieved with less human-power. That means that even though unemployment numbers are down, top companies can continue to operate and generate a profit with fewer people.

7. 40% Of S&P 500 Revenues Come From Abroad

The top companies in the U.S. stock market are much more global than an average American firm. Attributing up to 40% of their revenues from abroad.

Closing Points

- The stock market does not reflect the health of the economy.

- If there’s anything COVID-19 taught us, it’s the importance of diversifying our income streams, having emergency funds, and being stable enough for the unexpected.

Comments? Questions?

So what are your thoughts. What perplexes you about the disconnect between the stock market and the economy?