November 3rd is a historical day for the USA. Early votes already count for 70% of the 2016 election. And even as the ebbs and flows of this election collectively hold our stomachs in knots, we’d like to friendly nudge, our dollars continue to ?? vote ?? everyday.

To kick it off, we’d like to start it off with a wild statement, the consumer is the most powerful player of the economy. They may not know this, but over time not only have they changed the zeitgeist of what companies expect its customers to purchase, but also how they prepare the product and who they are as a company.

The ?? consumer ?? is the most powerful player of the economy.

It is through these levers, the zeitgeist continues to morph and change into hopefully a more sustainable and socially impactful world. In fact, consumer spending accounts for 70% of the U.S. Economy.

Discretionary Spending

Discretionary spending (not to be confused with consumer spending) is considered to be the money you are leftover with after you finish paying off your essential costs. According to the U.S. Bureau of Labor Statistics in 2018, most people spend discretionary income on entertainment (8%), dining (5.6%), or gifts (2.2%). Brands need to stay appealing to the everyday consumer, and over time consumers have changed not just what to spend money on, but also on who. Brands need to align with having more sustainable practices and having principles that align more with their purchasing communities. In fact, it could be argued that we have morphed the relationship from a brand to consumer relationship, to a brand to community relationship.

We have morphed the relationship from a brand to consumer relationship, to a brand to community relationship.

Tweet

Local Economies

Local economies have risen during the 2020 recession with the Shopify stock rising from its lowest $282.08 to its highest $1,146.91 and Etsy $29.95 to $154.88. This massive jump in share price reflects a new wave of small businesses growing in order to survive during mandatory and voluntary Stay-At-Home orders. Supporting our local economies helps keep local dollars within the community, improve schools and the cleanliness of our communities.

Our Behaviors

If there’s any proof our behaviors affect the stock market, it’s definitely the 2020 stock market reaction when the S&P 500 Index hit it’s lowest on March 23 at $2,237 to peaking $3,581 in September. As the economy slowly started to open up during the summer months, consumers with discretionary spending adapted to the new normal. The new normal being, “doing curb-side pick ups”, and willing to do “drive-thru moving watching”, etc.

We also account for the CARES Act Stimulus signed on March 27, 2020, which did help to jumpstart the economy, encouraging investor confidence in the stock market.

Everyday Purchases

Ironically, though the 2020 recession has encouraged a rise in local economies it has also increased market share for incredibly large tech companies that focus on home deliveries, such as Amazon or courier services. In March, Amazon went from its lowest of $1,626 to its highest at $3,552, doubling its stock price. Stay-at-home orders reduced the number of methods the everyday consumer had in obtaining their usual items. Many relied on Amazon or courier services to do normal grocery / essential errands.

Social Impact / Sustainable Funds

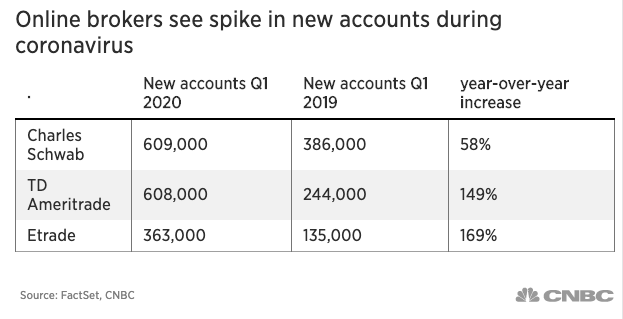

With the opening of fractional shares in 2020 and new stock buying platforms such as robinhood.com or public.com (shameless plug, check us out on Public) we are seeing of thousands new investors joining their share of the stock market.

And just like consumer products, they also want the right funds to invest in so that they help shape the world they want to see.

Time & Energy

Over time, consumers have shown to prefer convenience over cost. Time is more valued. With so many new technology products and apps, many are doing their best to optimize their days so that they can make the most of their life. Many are prioritizing experiences (travel, events) vs. physical products.

Conclusion

We power our dollar everyday by deciding where to spend it. Whether we decide to feed into local economies in person, Etsy, Shopify, Amazon, etc. Whether we decide we will travel or will stay put determines how the stock market will react to our behaviors long term, especially during a pandemic.

If there’s any proof that our collective actions affect the economy, or even the stock market, know that the foundation of the stock market is first on human behavior and how we respond collectively. (Complete tangent, highly recommend reading about ant colonies. Guy Spier a Zurich-based investor, highly recommends it.)

If you want further proof, check out how companies have now become more socially conscious, or how they are slowly starting to respond at the C-level.

? What are your thoughts? Do you agree that these are ways the everyday consumer has to change the world? What would you add to it?

I got what you intend,bookmarked, very decent website.

I am incessantly thought about this, thanks for posting.

I reckon something truly special in this website.