About B, a Former Options Trader

B has been an options trader since graduating from college in 2013. He has over six years of excruciating day-trading-options experience working the market hours in the midwest. He has since left his trading career to cater to more meaningful activities in life. He has held and managed various options and futures positions totaling up to 5 million, for up to 6 months at a time. He was responsible for volatility skews (i.e. determining option pricing) and setting “edge” requirements for VIX options in response to order and flow risk parameters. Ultimately, over time he has made his firm over 5 million.

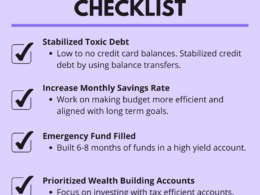

Trigger Warning: Options trading has recently come into the limelight due to a former Robinhood (a popular trading app) 20-year old user who committed suicide due to a large six-figure negative balance within the app. So, please, please when it comes to investing, do your homework, have an emergency fund, and be willing to lose a percentage of the funds you commit.

A few glossary learnings before we start:

Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell an underlying asset at an agreed-upon price and date.

Investopedia’s definition of Options

Call options and put options form the basis for a wide range of option strategies designed for hedging, income, or speculation.

Quantitative easing (QE) is a form of unconventional monetary policy in which a central bank purchases longer-term securities from the open market in order to increase the money supply and encourage lending and investment. … Instead, a central bank can target specified amounts of assets to purchase.

Investopedia‘s definition of QE

1. The market is not rational

“There have been multiple studies done that have shown that if a bunch of monkeys started throwing darts at a financial dartboard, some would get rich, but the majority would go broke.”

Recommended Reading:

Check out “A Random Walk Down Wallstreet” to learn more about the study and overall financial levers.

2. THIS market in particular is irrational

“The fed has been printing money to keep up the stock market since ’09 or whenever the first bailout and QE (quantitative easing) was. In the word of Wall Street bets (a popular private Reddit forum amongst traders), “money printer go BRRR.” It’s actually probably not a bad market to invest in overall, as the financial/political interests that be have strong incentives to keep the stock market high to keep the populace docile and keep their butts on staying elected? However, I’d continue to be on the lookout for signs of whenever the market stops responding to arbitrarily printed money. So far so good as far as QE goes, but it seems like an addiction to easy money and low-interest rates for those in political power, and god knows what happens when our economy stops responding to it.”

3. With enough of your own “true day trading” capital on the line, you’re essentially experiencing something similar to the stress/time commitment of a first responder, a soldier in an active combat zone, or a high-stress always-on profession

“Things will happen that are outside of your control far more often than things that are inside your control. It takes being constantly being plugged in and when you consider the computing power and technical and financial wizardry the big boys use, the amount of work you’d need to do to not end up a bug stuck to the bottom of their boot when a real move happens is near endless.”

Imagine having up to 5 million on the line and having to make a decision within a few seconds just with the click of a few buttons…

4. The stress/time commitment of just learning what you’re doing

“I’m on Reddit a lot and subscribed to most of the bigger trading Reddit and the number of posts that are, “hi I’m thinking about/have just quit my day job and started trading btc/options/on Robinhood … what’s a call and a put/how do I become a good trader/what is a good size to start trading at?!” B**** please.”

5. Ask yourself, couldn’t you be doing something more productive with your time

“If you think you have the time to trade now, whether it be because you’re WFH, or unemployed/underemployed/furloughed, you have the time to develop a skill that has (I promise you) a far higher percentage chance of increasing your earnings or your ego and sense of fulfillment. Learn Python, learn a foreign language, learn about how to take advantage of the tax system, pursue some sort of online training/certification in your chosen field. I think a lot of people are experiencing a mix of FOMO and excitement, but that’s not worth risking your financial future and potentially your sanity over.”

6. There are ways to consistently make money trading in the stock market, but often it comes down to structural advantages that big players have created to become more like casinos than the gamblers

“There ARE ways to consistently make money trading in the stock market, but often it comes down to structural advantages that big players have created to become more like casinos than the gamblers therein. Such as being physically close to exchange with several fiber-optic connections to minimize latency. Swinging so much capital that you can move markets (albeit temporarily) yourself. Fulfilling customer orders of being a market-making firm. Having deals with exchanges that cut down your fees massively. Tax advantages. AI systems and hiring data scientists, physicists, coders, etc.”

7. You’ll never beat the machines

In case you didn’t know this but a lot of trading firms are laying off their day time traders and hiring more engineers to build algorithms to compete with big tech hedge funds. The average stock is held from 20-22 seconds. Ask yourself if you have the time or tools to be ready to beat machines competing on 20-22 second trades.

If buffet could whiff as bad as he did on airlines, we all have no chance.Tweet

Options trading is like falling face down on a treadmill going very very fast. The catch? Sometimes this endeavor pays off in extraordinary ways. Other times it stabs you in the soul lol. It’s the ultimate challenge and I love it but it’s amazing how quickly a 3 month win streak can turn into “where’d the money go?” Successful options trading is strategy based with rules you follow outside of emotion. It’s like telling yourself not to think.. sounds easy until you try. I’ve been good and followed the rules for 20 trades then slipped up once and it negated all the good. Important lessons? Never double down on a mistake. Take your reasonable gain and don’t sweat a calculated loss. Anything else and you’ll be broke in no time.