What’s Inflation?

What’s inflation? Basically, every year the value of the dollar is decreasing and things are becoming more expensive. Right now, the average rate of inflation is 3%. That means if you had $100 in your bank account in January, it would really be worth $97 by the end of the year. You would still literally have $100 but it might only buy you what $97 before would have bought you at the beginning of the year. That’s three less cans of Arizona! (If they forever stay at $0.99.)

So let’s imagine you’re a 25-year old. You’ve been working for a little while, and decide you want to start saving for your retirement. Now, your gut reaction is probably to start putting money in your traditional bank account, probably the same one you set up as a direct deposit with your job, right? That’s what your mom and dad might have done.

What’s an APY?

What’s your average APY on your bank savings account? Don’t know what an APY is? Basically, APY, or annual percent yield, is the rate of interest which banks put back into your savings account for you letting them borrow your money. If you didn’t know, when you put money in a bank savings account, they are basically investing it on the stock market and giving you back some of the gains. That’s why you might hear things like, “We’re FDIC-insured and can protect up to $250,000 of your assets.” That’s in case they actually lose your money.

Okay, so here are some common APYs for the most popular national banks in the US. Which one do you have, friend?

- Bank of America: 0.01% APY

- Wells Fargo: 0.01% APY

- Chase: 0.01% with option to increase up to 0.05% APY

- U.S. Bank: 0.01% APY

- PNC Bank: 0.02% APY

What did I say was the average annual rate of inflation?

It’s 3%!

So basically, let’s assume that you have a standard savings account with 0.01% and you start saving $100 a month. Technically, you may have saved $1200 by the end of the year, but because inflation is 3% and your interest rate is 0.01%, that’s really like -2.99%. You’re still in the red.

Let’s say you’re a little smarter than the average bear, and you decide to move your savings to a high interest savings account. Let’s say the average APY is 0.8%. That’s pretty good, it’s better than most standard savings accounts. What was inflation again? Oh, 3%, so you’re still down -2.2%. Still in the red.

Let Me Introduce You To Roth IRAs

In the case of Roth IRAs, the tax advantage is realized during your retirement, because you don’t pay taxes on the money you withdraw. To get this nifty treat, you pay the taxes up front before you deposit the money into the account. This is the opposite of Traditional IRAs, which allows you to deposit money and then pay taxes later (when you withdraw). While traditional IRAs seem attractive, and they do have merit, who really wants to pay taxes when they’re 60? (Especially on your hard earned cash!). With a Roth IRA, you can set up a portfolio filled with index funds of stocks and bonds and contribute towards your retirement and withdraw your earnings tax free.

Breaking down the S&P 500

Okay, so how well can a Roth IRA do in comparison to your normal savings account or a high yield savings account? Well, for the sake of simplicity, let’s imagine your Roth IRA was made up entirely of the S&P 500 Index. You might have seen this ‘ticker’ scrolling across the TV when you’re watching the news. The S&P 500 is basically a really big exchange-traded fund (ETF) (or index fund) that is a bundle of the 500 largest companies in the US. Investors like to think of how well the S&P 500 does as a stand-in for the “market” or the US economy. Historically, the interest rate for the S&P 500 index has been 9.8% annually!

So if you had saved and invested your money in a Roth IRA with an APY of 9.8%, and you account for inflation, that still leaves you with 6.8% in interest on your investment. This finally puts you in the green!

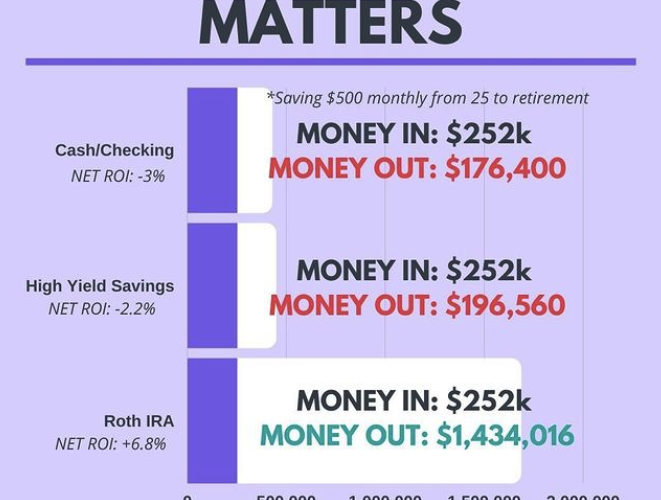

Here’s a quick graphic from our instagram to help summarize this for you.

As you can see, if you started investing $500 monthly from 25 until retirement, you could have radically different futures depending on where you save it. Your regular savings account and a high yield savings account would do about the same, but the Roth IRA in this example allows you to earn exponentially more income by the time you retire. That’s the power of compounding interest!

Convinced and want to learn more about Roth IRAs and how to open one? Check out this article by Rebecka that covers more of the technical aspects behind them: Fund Your Roth IRA + Why They’re Not Just For Retirement

Awesome article Daniel!