Investing has lots of perks but before heading towards that route, you need to build a plan where investing works with the income you have. Prepare yourself to make your money work for YOU. Here are four steps to consider before planning for investments.

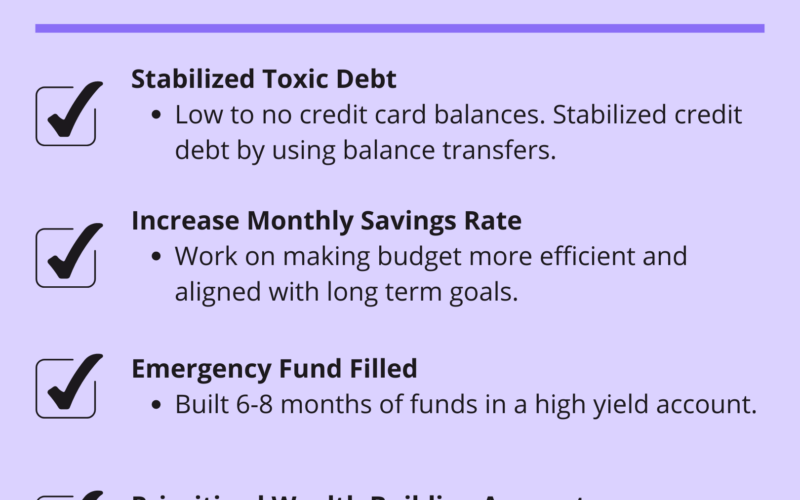

Step 1: Stabilize Toxic Debt

This step is crucial. What are the interest rates you’re paying for your credit cards, mortgage, cars or other debts? If you’re investing with a 6%-8% ROI but paying large balances on credits cards with 20%-24% APR, you’re not going to be able to grow wealth. Focus on paying off debt with high interest first—checkout First Milli’s Credit Card Payoff Calculator. Don’t let all your hard-earned dollars go towards interest fees.

Step 2: Save To Invest, Work On Budget Cuts & Increase Your Savings Rate

Create a budget that works for you where you don’t feel you’re restricting yourself completely. Let’s assume you have an annual income of $55,000, living in California. After taxes, your yearly pay is about $43,000, bringing your monthly income to $3,583.

Total Monthly Income: $3,583

Total Monthly Expenses: $2,828

Rent – $1,200

Renters Insurance – $8

Internet – $50

Utilities – $60

Cell Phone – $80

Groceries – $320

Household Items (toilet paper, soap, laundry detergent, etc.) – $50

Car Insurance – $150

Car Payment – $270

Gas – $100

Online Streaming Services (Hulu, Netflix, Spotify, Amazon, etc.) – $40

Personal (shampoo, toothpaste, etc) – $50

Other debt (personal or student) – $300

Entertainment (New video game, takeout, purchasing new clothing, etc.) – $150

Amount leftover – $755 (21% Savings Rate)

When working through your budget, start from the most expensive items and work out how you can “Negotiate, Eliminate or Substitute”. When you focus on “how you can increase your savings rate” your brain starts to get into a problem solving state of mind.

Maybe you want to attempt a “No Spend Month”. Maybe you’ll focus more on bulk buying. Maybe you’ll downsize your car. Or maybe you’ll consider moving with friends or family to reduce housing costs. Maybe your family will work out a bundled family cell phone plan or car insurance bundle. Or maybe consider borrowing the credentials to your favorite streaming services. (Shoutout to all the friends who still let me borrow their streaming accounts after seven years.) Or maybe you’ll focus on knocking out that $300 monthly debt.

Or possibly you’ll focus on increasing your savings rate by earning more money via side hustles.

Think about your needs versus wants and be honest with yourself. We usually recommend aiming for a 30-40% saving rate. Work your way slowly. Remember, only you know your situation the most and what may work for someone else may not work for you.

Step 3: Emergency Fund

This past year, I think we can all truly understand the importance of “saving for a rainy day” because it poured. It’s essential to have a savings emergency fund covering six to nine months of your monthly fixed costs. While you’re collecting all that cash, store it in a high yield savings account—checkout January 2021 HYSA Rates article to browse around some available options.

Step 4: Prioritize Wealth Building Accounts

Before investing, the final step is maximizing tax efficient accounts and then opening taxable accounts. Having a tax efficient (Roth IRA, 401k, etc.) account allows your dollars to invest and grow more powerfully by being smarter with taxes.

And as always, establish goals and financial plans before investing your mula.

Questions, comments? Excited to engage.