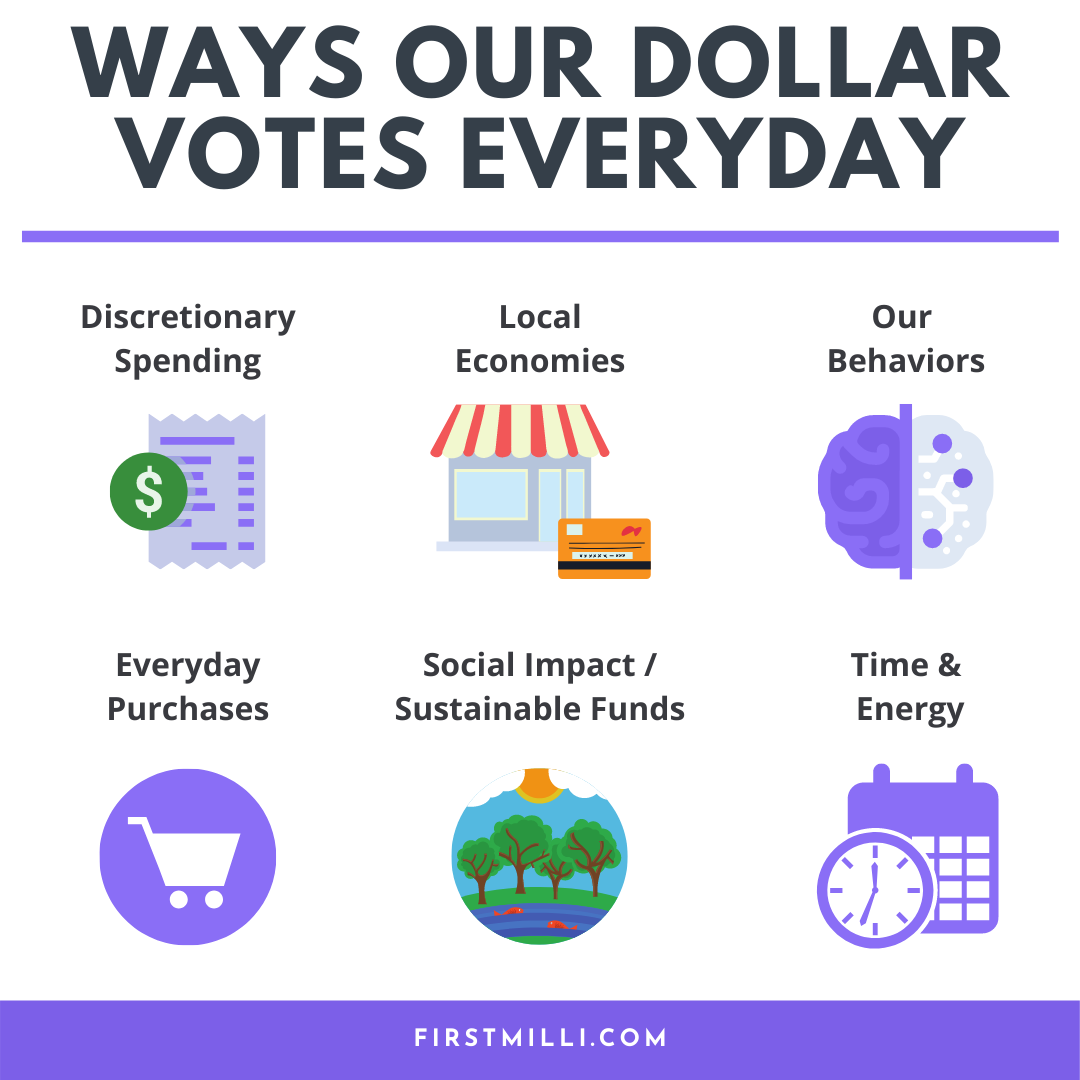

Here’s the thing no one tells you about wealth building from zero (or negative) that you realize over time, it requires you to grow at an emotional and conscious level. Our relationship with money is a very personal one. Our spending habits reflect us. They reflect our money wounds, and how we deal with our insecurities, or rather, how they overrun us. It’s as Vicki Robin from “Your Money or Your Life” puts it “we trade our life energy for money”, and perhaps we’ll add an addendum to that…”until we don’t have to.”

As the humans that we are, we have to consciously and unconsciously manage our various day to day life requirements. We have to manage the voices in our head that range from “COVID, masks, gloves” to “bills, paycheck, food, family.” We need to find ways in narrowing our focus on a daily level that helps us build towards our wealth goals.

Nailing our wealth goals requires a combination of tangible and intangible change. We need to see the numbers move and we need our behaviors to shift. And with that, we need to start small.

Here are 3 ways we’ve learned via many success stories and literature that enable us to reach our goals:

1. Goals need to be SMART

It’s important to have 2-3 large goals you are 80% likely to achieve that contain each of the following tenets:

- Specific (simple, sensible, significant)

- Measurable (meaningful, motivating)

- Achievable (agreed, attainable)

- Relevant (reasonable, realistic and resourced, results-based)

- Time bound (time-based, time limited, time/cost limited, timely, time-sensitive)

Here’s an example: Stacy is -$20,000 in debt and able to manage $500 leftover after fixed costs, here are her SMART goals.

Goal: Within 12 months she wishes to payoff 30% of her debt (a number we already know she can reasonable hit today), 50% being a stretch goal (a number if she pushes to earn or free up $400 extra monthly)

- She will contribute $500 monthly to paying off her debt. She will review her budget line items and try to cut, reduce or negotiate wherever she can. Furthermore she will explore feasible side incomes to add an extra $400 to her monthly debt payoff. Thus, paying off $900 monthly (enabling to hit her stretch goal).

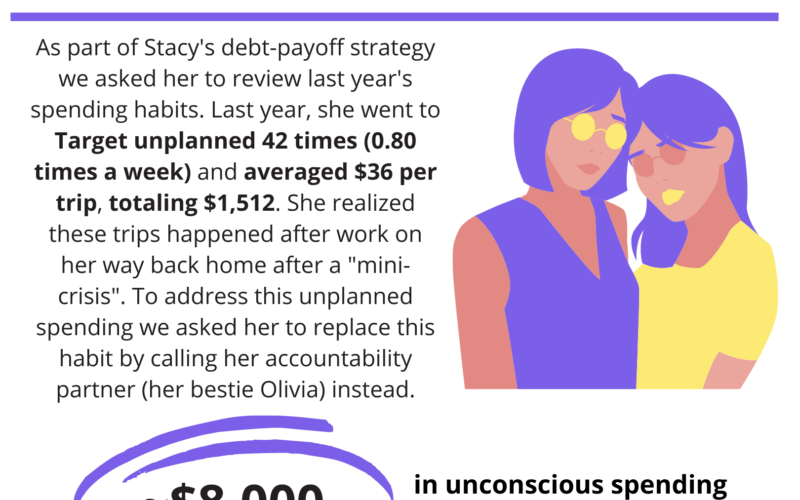

- Stacy spent time reviewing last year’s expenses in search of her spending habits and realizes she went to Target unplanned 42 times (0.80 times a week) and engaged on an average of $36 per trip, totaling $1,512. She visualized the feelings she had before these unplanned trips and could pinpoint them to when she was dealing with a mini innocent crisis, from a bad day at work to a spat with her partner or friend. She realized these trips mostly happened after her work on her way back home. She would soothe her mini crsis when she would be at a red light and see Target beckoning her. She mostly bought pleasantly scented candles, Starbucks coffee, chocolate, chips, and some beauty product. She has identified this behavior and has prepared a crisis management plan. She will call her accountability partner who will be ready to remind her of her goal and help her find ways to replace that habit with something Stacy is happy to do. Stacy promises she will give this process a chance without question and see how it works out for her.

- She will use physical reminders everyday to remind herself of her goal. She may decide to add a debt payoff wall chart in her closet and another on her fridge. She also identified a few temporary sacrifices she will make to reach her goals, such as downgrading her car to a $2k reliable “wealth building” bucket.

- For 12 months she will contribute $500-900 a month to her debt. $207 on a weekly basis. $29 on a daily basis. She will need to find ways to increase her debt payoff rate by $13.

2. Group Accountability

Stacy has enlisted her whole family as part of the goal. She has expressed to them what the reward will look like for the whole family when they reach their goal and has even tasked them with identifying frugal joys.

3. Self Awareness

We are wired to optimize, to be creative. When we narrow down so hard on a goal our energies will translate that into optimizations. One morning, Stacy will eventually stare at her wall chart and see her balance drop by $500 and will feel that’s not enough for her. She will dig into herself to find further ways she can increase that number. She will begin focusing all of her energy in identifying old habits and replacing them with new and attainable ones she enjoys.

What drives Stacy’s efforts are breaking down her goals into smaller ones. They soon become so small she finds ways to optimizes them at their micro level. If instead, Stacy focused on paying off $20k she’d find herself overwhelmed with such a massive number. But a specific shift happens to Stacy when she learned she could decrease her $20k of debt by 50% with only an extra $16 a day. She is then able to focus all of her energies to move that $16 increase needle. Over time she’ll recognize a shift in her brain and habit formations where her $3 money moves become $30 money moves and soon she’ll snowball herself into $300 to $3000 money moves.

Wealth building is all about finding ways to break down large goals into smaller goals and identifying our habits that don’t add to our goals and changing them. It starts small.