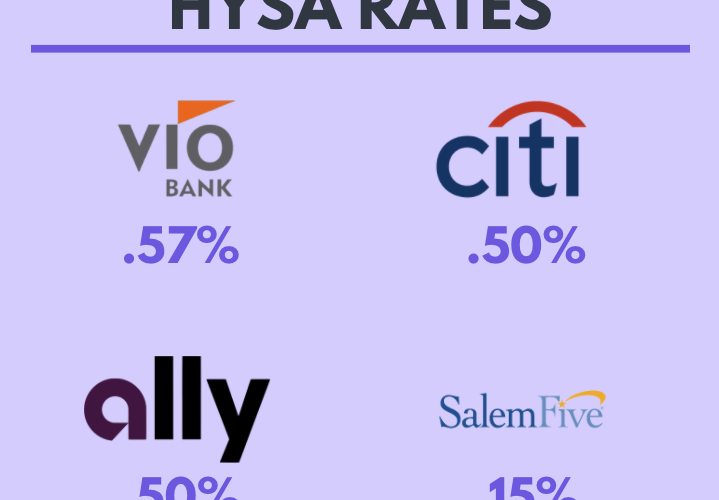

Saving for a rainy day, or possibly another pandemic? Too soon? Take advantage of opening a high yield savings account. If you currently have a savings account with a traditional bank, check your APR (annual percentage rate) and compare it to the list we’ve curated for you below.

Salem Five Direct – .15%

Salem Five Direct currently offers .15% in savings with the minimum balance to open an account between $10 – $100. The minimum account balance to obtain the annual percentage yield is $0.01, so yes, you only need 1 cent in your account.

Vio Bank – .57%

Vio Bank is at .57% for a new account with interest being compounded daily. The minimum balance to open an account is $100 with no monthly fees and 6 free withdrawals per monthly statement. Vio Bank is insured up to $250,000 with FDIC (Federal Deposit Insurance Corporation).

Citibank – .50%

Citibank is offering .50% in savings accounts with no minimum opening deposit. There is a monthly fee associated with the account unless you make one qualifying deposit and one qualifying bill payment per statement. If you don’t have a Citibank account the savings account will be opened within a banking package.

Ally – .50%

Ally is currently offering .50% APR with new accounts. Ally provides buckets to setup an account and encourages you to add more to a savings account through recurring transfers, round ups, and links to a checking account for surprise savings. There is no monthly maintenance fees or minimum balance requirements.

Each savings account offers different options so before opening an account, check to see what works best for you. This is your financial journey and First Milli is here to support your goals!