If you can, consider funding a Roth IRA

Okay, we do our best not to “push advice”, but seriously, there are so many reasons why a Roth IRA is cool. We’re like the not so cool kids marching down the high school cafeteria trying to get all the cool kids (AHEM YOU) to fund a Roth IRA. One large reason many don’t use tax efficient retirement accounts is because they feel they may need to use the money for something else. So cue the Roth IRA, they can be used for so many different things.

At the end of this article, if you qualify and if you haven’t done so, please consider contributing at the minimum $100-$500 monthly to fund a Roth IRA.

Why ROTH IRAs are cool, yes, we’re trying to make them a thing:

- Earnings grow tax-free. You’re going to want this when you’re 75 and don’t want to pay taxes.

- Contributions can be withdrawn at any time (different from interest earnings).

- “Okay, but what are contributions?”

- So pretty much if you decide to fund $500 into a Roth IRA and make $535, you can withdraw your contribution of $500.

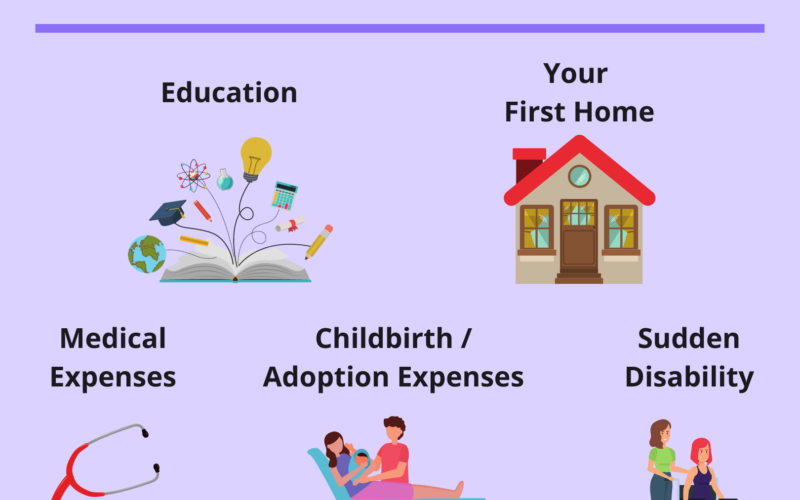

- Money can be used for a bunch of cool stuff like education or a first home.

- Roth IRA may not be factored into FAFSA, so you could qualify for more aid. (This is a maybe since there’s a lot of differing literature on this. As always, please consult with your certified tax professional.)

| Can withdraw for… | Rules | Further Thoughts |

| Education | Can be used for college tuition or other qualified educational expenses. Earnings will be taxed as income, but the penalty does not apply. | Maybe you want to pay for your own college expenses, your children, or even your children’s children. |

| First Home | After being funded for five years, up to $10,000 in earnings to buy a first home, tax and penalty free | Married couples can pool up to $20k. $10k from each account. |

| Medical Expenses | Paying medical expenses greater than 7.5% of your AGI if you’re 65 or older. Or 10% for those below 65. | Does quarantining for COVID count? |

| Sudden Disability | If you suddenly become disabled, you are able to use your IRA to pay for these costs. | Um, does COVID count for these 2 weeks? |

| Birth Expenses | Can use up to $5k to cover the cost for childbirth without paying a penalty. | Average baby costs are $30-$47k, so this is useful. Note, this only applies after childbirth. You basically have a year to exercise the withdrawal penalty-free. In order to do this, your Roth needs to be funded for at least 5 years to avoid the penalty. So fund it with whatever you got to start the clock. |

| Adoption Expenses | Can use up to $5k to cover the cost for adoption without paying a penalty. | The average cost to adopt is $43k, so this is useful. In order to do this, your Roth needs to be funded for at least 5 years to avoid the penalty. So fund it with whatever you got to start the clock. |

Requirements for a Roth:

| Requirements | |

| Income | Must have earned income within the year. Earned income means you pretty much have to work for somebody or your business needs to make money. Unemployment, alimony, child support, and income from rental property do not count. Please check out the full list here. |

| Age | Anyone who earned income, no age restrictions could be a teenager with a summer job (a parent/adult needs to open a custodial Roth IRA for the minor) |

HOW: Okay cool so how much can I contribute

Adjusted Gross Income is pretty much the amount of income you made in a taxable year that the government can take from you. If you donate, that might reduce your AGI. Even contributing to an HSA, tax-loss harvesting or further deductions reduces your AGI.

| For 2020, if you file as… | And your modified AGI is… | Then you can contribute… |

| married filing jointly or qualifying widow(er) | < $196,000 | up to the limit ($6k, $7k if you’re 50 or older) |

| married filing jointly or qualifying widow(er) | $196,000 but < $206,000 | a reduced amount |

| married filing jointly or qualifying widow(er) | > $206,000 | zero |

| married filing separately and you lived with your spouse at any time during the year | < $10,000 | a reduced amount |

| married filing separately and you lived with your spouse at any time during the year | > $10,000 | zero |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year | < $124,000 | up to the limit ($6k, $7k if you’re 50 or older) |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year | > $124,000 but < $139,000 | a reduced amount |

| single, head of household, or married filing separately and you did not live with your spouse at any time during the year | > $139,000 | zero |

If you can file for reduced, check this out:

- Here’s a cool worksheet from the IRS to figure out that reduced limit. Good luck, it’s mega-complex.

WHERE: But where should I contribute

There are multiple ways you can create a Roth and you don’t need $1000. You can fund a Roth with $500 or even $25. Should only take 15 minutes. Check out robo-advisors like Titan (our current favorite), Wealthfront, or Betterment. Or check out your traditional options such as Vanguard, Fidelity, Charles Schwab, etc. Point is, if you’re unsure, pick a platform, close your eyes, turn around in circles, hop five times, and pick one blindly. Inaction is the enemy of progress.