All those months of waiting on the stimulus, combined with the need to purchase basics, added up in credit card statements. Time to focus on your financial journey and kick some credit card debts’ a$$.

1. Avalanche Method

Focusing on the card with the highest credit card annual percentage rate (APR%), and paying the minimum balance on others can be beneficial in the long run. For example, if we have three cards:

- Credit Card A – 22% (APR)

- Balance = $1500

- Yearly interest owed = $330

- Credit Card B – 16% (APR)

- Balance = $1500

- Yearly interest owed = $240

- Credit Card C – 14% (APR)

- Balance = $1500

- Yearly interest owed = $210

The interest owed from Credit Card A to Credit Card C is a $120 difference per year! This number gets higher when the balance is larger. Budgeting more towards the balance with the higher interest rate can help ensure you’re paying more of the balance and less of the growing interest fees.

2. Working on Building Side Income

Adding a side income can help pay-off credit card debt harder, better, faster, stronger. Say a gig that pays $20 an hour, five hours a week; that’s a total of $100 per week. After a month’s work, that totals up to $400 towards credit debt. Multiply that month by a year and that’s $4,800 towards credit debt.

3. Consider Balance Transfers

Redefining debt and using it to your advantage with new credit cards at 0% interest between 18-24 months could save lots of cash in interest fees. By transferring credit card debt to a new account with 0% interest, the payments directly affect the total debt balance. Confirm if there are any transfer fees associated before moving the balance over. I love it when money isn’t spent on interest fees, don’t you?

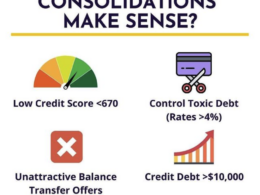

4. Consolidate Debt When Needed

Making one payment for the total debt can be ideal for some situations. This scenario can come in handy if your credit score is good. It makes sense when a consolidated credit card loan is lower than the current credit card APR rate.

5. Ask to Reduce Monthly APR %

As the saying goes, closed mouths don’t get fed! Asking for a lower interest rate does not affect your credit score. With a good credit score and a long account history with payments made on time, it can be leveraged to ask for a lower APR % on a credit card. It never hurts to say you found a credit card with a lower APR rate you’d be willing to switch over.

6. Ask to Remove Monthly Interest Fees

As mentioned above, closed mouths don’t get fed! Leverage the account history, payment history, and credit score to make a case. Believe in yourself to get the task done.